July 4, 4:30 GMT: RBA Interest Rate Decision

Although there were rumors the Reserve Bank of Australia would put the rate increase on hold, economic metrics still need to be more satisfying. If the RBA raises the interest rate, it will support the Australian dollar but mean the economy isn’t in good condition.

July 7, 12:30 GMT: Nonfarm Payrolls

As usual, markets will follow the release of Nonfarm Payrolls data on the first Friday of the month. If the actual figure outperforms the forecast, the US dollar may increase, causing a depreciation of those assets paired with it.

July 7, 12:30 GMT: US Unemployment Rate

Besides the number of new jobs created in all non-agricultural businesses, traders will evaluate the unemployment rate, which also impacts the Fed’s monetary policy decisions. The lower the unemployment rate, the better economic conditions, and the higher the US dollar.

July 12, 12:30 GMT: US Inflation Data

Inflation is another critical metric determining the strength of an economy. Traders will consider the inflation rate, core inflation rate, and CPI, comparing it to the previous data and data from a year ago. If inflation goes down, it will allow the Fed to put the interest rate increase on hold.

July 19, 06:00 GMT: UK Inflation Rate

Although the Bank of England implements various monetary policy tools to lower the inflation rate, it’s still above the BOE’s target. Traders will pay attention to YoY and MoM inflation rates, and if they decline, it will be a positive signal for the GBP.

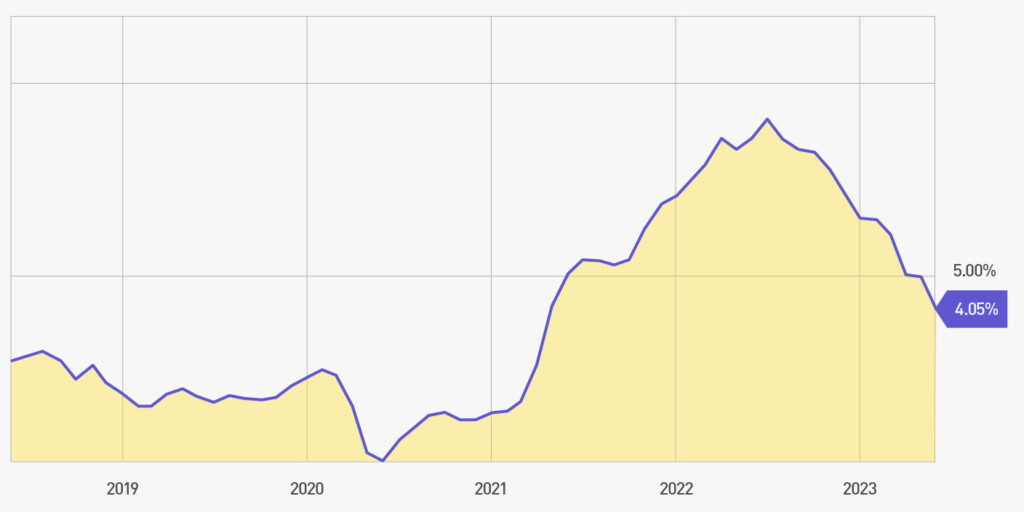

July 26, 18:00 GMT: Fed Interest Rate Decision

The Federal Reserve will announce its interest rate decision. The markets expect the central bank will stop raising the rates, but economic metrics don’t match the bank’s targets, so another increase may occur. A rate hike will support the USD.

July 27, 12:15 GMT: ECB Interest Rate Decision

The European Central Bank will announce its interest rate decision. The ECB tries to lower the enormous inflation rate by raising the rates. If another rate hike occurs in July, it will support the euro but still mean inflation isn’t controlled.

July 31, 09:00 GMT: EU Inflation Rate

On the last day of the month, the markets will wait for a release of the Eurozone’s inflation data (inflation rate YoY flash, inflation rate MoM flash, core inflation rate YoY flash). In the Eurozone, inflation is above the ECB target, so a decline will positively impact the euro value.