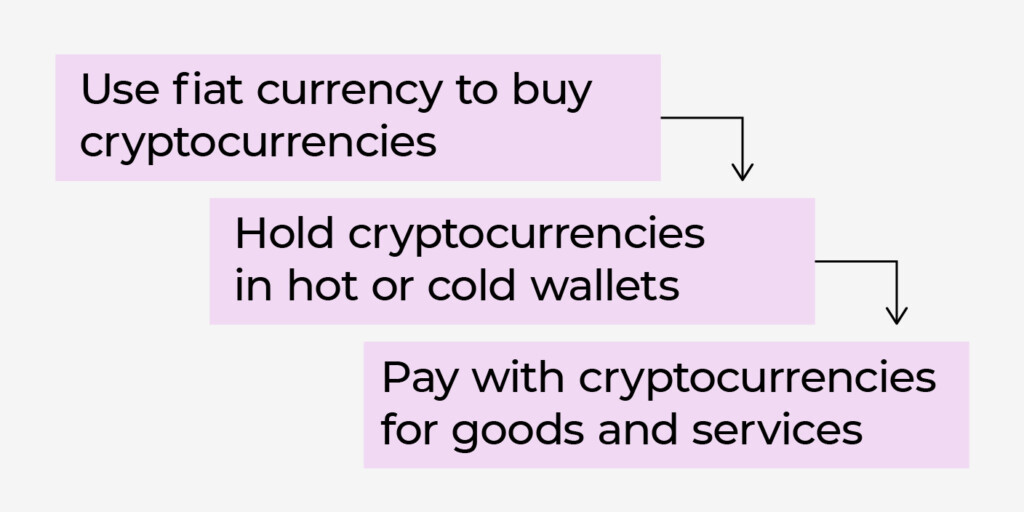

Using cryptocurrencies worldwide typically involves the following steps:

- Set up a cryptocurrency wallet: With various wallet options, including desktop, mobile, hardware, or online wallets, you can choose the one that suits your needs. Each type of wallet has advantages and security features, so do your research and choose one that fits your needs.

- Acquire cryptocurrencies: Once you have a wallet, you must acquire cryptocurrencies. You can do this by buying them from a cryptocurrency exchange, receiving them as payment for goods or services, or mining them (in the case of proof-of-work cryptocurrencies). Ensure you follow the regulations and laws regarding cryptocurrency acquisition in your country or region.

- Familiarize yourself with cryptocurrency transactions: Cryptocurrency transactions differ from traditional ones. They involve sending and receiving digital currency using unique wallet addresses and private keys. Learn how to generate and use wallet addresses, send and receive cryptocurrencies, and how transaction fees work.

- Use cryptocurrencies for transactions: Cryptocurrencies can be used for various purposes, including online and offline transactions. Many online merchants and service providers accept cryptocurrencies as payment, and some physical stores also allow customers to pay with cryptocurrencies. Double-check the recipient’s wallet address to avoid sending funds to the wrong address when making a cryptocurrency transaction.

- Be aware of cryptocurrency regulations: Cryptocurrency regulations vary from country to country, and knowing your area’s legal landscape is essential. Some countries may have restrictions or regulations on the use of cryptocurrencies, so it’s essential to understand the legal implications of using cryptocurrencies in your jurisdiction.

- Take security precautions: Cryptocurrency transactions are irreversible, and the digital nature of cryptocurrencies makes them susceptible to hacking and fraud. Take proper security precautions, such as using strong and unique passwords, enabling two-factor authentication (2FA), and securing your wallet and private keys. Be cautious of phishing attempts, scams, and other fraudulent activities in cryptocurrency.

- Stay informed about the cryptocurrency market: The cryptocurrency market is highly volatile, and prices can fluctuate significantly. Stay informed about the latest news, trends, and developments in the cryptocurrency market to make informed decisions about using cryptocurrencies worldwide.

Note: The use of cryptocurrencies worldwide is constantly evolving, and regulations and acceptance levels may vary by country or region. Always research and understand the legal and regulatory landscape before using cryptocurrencies for transactions.

How to start using cryptocurrencies?

Here are 3 steps to becoming a crypto owner:

Let’s see how these steps are done.

Buying, holding, and using cryptocurrencies

“What’s cryptocurrency trading?” is a common question asked by those who are new to the concept. It refers to the buying, selling, and exchanging of digital currencies such as Bitcoin, Ethereum, and others on online platforms known as cryptocurrency exchanges. Cryptocurrencies have gained immense popularity as a form of digital currency in recent years. Buying, holding, and using cryptocurrencies involves several key steps and considerations.

Buying Cryptocurrencies

If you’re wondering, “is crypto trading profitable?”, the answer is yes and no. Depending on your knowledge about the industry and your research strategy. The first step in acquiring cryptocurrencies is to buy them from a cryptocurrency exchange. Numerous centralized and decentralized cryptocurrency exchanges allow users to purchase cryptocurrencies using various payment methods, such as credit cards, bank transfers, or even other cryptocurrencies. Choose a reputable and secure exchange, like Binance, and understand the fees, regulations, and verification requirements of buying cryptocurrencies.

Holding Cryptocurrencies

Once you have purchased cryptocurrencies, you need a secure digital wallet to store them. A digital wallet is a software application or a hardware device that allows you to store, send, and receive cryptocurrencies securely. There are different types of wallets, including desktop, mobile, web, and hardware wallets. Each type has its pros and cons in terms of security and convenience. It’s crucial to follow best practices for securing your digital wallet, such as using strong passwords, enabling two-factor authentication, and keeping backups of your wallet’s private keys.

Using Cryptocurrencies

Cryptocurrencies can be used for various purposes, depending on their acceptance by merchants and businesses. Some merchants and online platforms accept cryptocurrencies as payment, while others do not. Using cryptocurrencies to make purchases, pay for services, or even send and receive money internationally without traditional banking systems. However, it’s essential to be cautious when using cryptocurrencies for transactions, as the transactions are irreversible and the value of cryptocurrencies can be volatile.

It’s also essential to learn why people trade cryptocurrencies to keep up-to-date with the regulatory environment surrounding cryptocurrencies in your country or region. Cryptocurrencies are still a relatively new and rapidly evolving technology, and their legal status, taxation, and regulations can vary widely across different jurisdictions.

Top crypto exchanges in 2022

| Wallet name | Number of supported currencies | Fees | Minimum buy and sell amounts | Advantages | Disadvantages | Accessibility |

Coinbase | 200+ | From 0.5% to 4.5% | $2 | 1. One of the most established and trusted crypto exchanges.2. High level of security.3. Low minimum buy and sell amounts. | 1. Higher transaction fees. | Website and mobile app for iOS and Android |

| Binance | 350+ | From 0,02% to 0,10% for instant buy/sell | $10 | 1. A large number of cryptocurrencies.2. Established crypto exchange.3. Low fees. | 1. Less user-friendly.2. Complex verification.3. Frequent technical glitches. | Website and mobile app for iOS and Android |

| CoinMarketCap | 9,000+ | 1. Website interface and navigation can be a little bit complicated for beginners. | Website and mobile app for iOS and Android | |||

| KuCoin | 700+ | From 0,0125% to 0,1% | $1 | 1. A large number of cryptocurrencies.2. Low fees.3. P2P transactions. 4. Advanced features.5. Users can earn interest on their crypto balance. | 1. Limited payment methods.2. Not suitable for new users. | Website and mobile app for iOS and Android |

All of these wallets can be used to buy and hold cryptocurrencies.

Note. ERC20 token transfers usually have the highest fees.

Do I have to pay the TDS tax?

No, you don’t have to pay TDS tax while buying cryptocurrency. However, you must pay a 30% tax on any cryptocurrency trading, selling, or spending earnings and a 1% TDS tax on any sales of cryptocurrency assets that exceed ₹50,000 in a single fiscal year.

Tax laws and regulations vary by country and jurisdiction and are subject to change over time. Therefore, it is essential to consult with a qualified tax professional or accountant in your location to get up-to-date and accurate information on whether you must pay TDS (Tax Deducted at Source) or any other taxes while buying cryptocurrencies.

In some jurisdictions, buying cryptocurrencies may be subject to TDS or other types of taxes, depending on various factors such as the transaction amount, the type of cryptocurrency, and the applicable tax laws. TDS is typically a mechanism used by tax authorities to collect tax at the time of the transaction rather than requiring the taxpayer to pay the tax separately later.

What is P2P?

P2P is a cryptocurrency exchange method in which people can directly exchange cryptocurrencies with each other and receive payments.

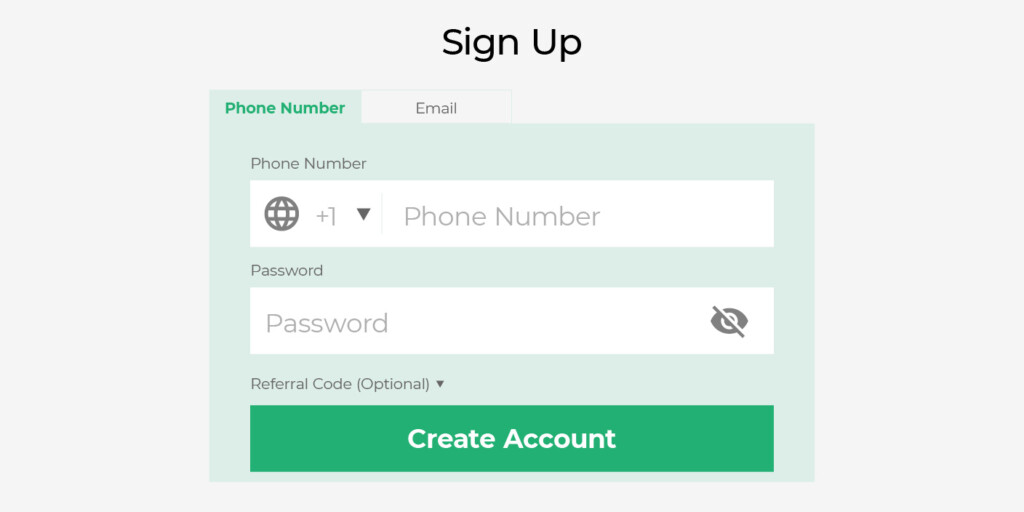

Using cryptocurrency

Choose a wallet you prefer and go to its website. Sign up to convert fiat into crypto coins (buy cryptocurrency). Here is KuCoin’s sign-up page:

The sign-up process is straightforward. In most cases, you only need to provide your name (make sure it matches your ID card), email address, mobile number, etc. Also, remember to set a strong password to secure your account.

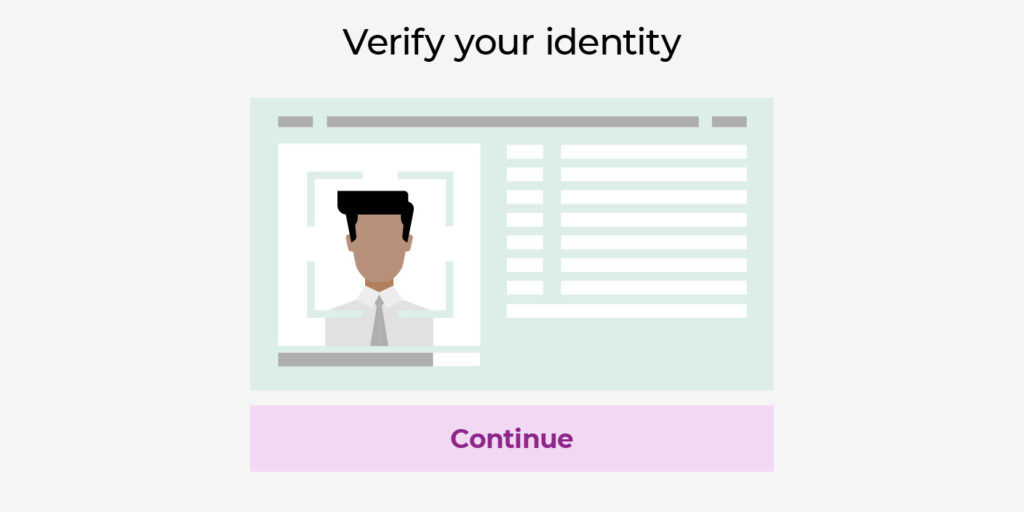

Identity verification and bank account details

After you have registered with a crypto exchange, you are just a few steps away from buying cryptocurrency. Please note that most crypto exchanges require identity verification.

After creating an account, you will see a page similar to this (Coinbase verification page).

Note. Most crypto exchanges take around 24 hours to verify the documents. After verification of your identity, you will be able to add your bank account details.

Upon completing your account setup, you will gain access to the ability to purchase cryptocurrency. Once acquired, you can utilize the coins for various purposes, such as sending them to others using a peer-to-peer (P2P) system, selling them for fiat currency, and subsequently withdrawing them to your linked bank account.

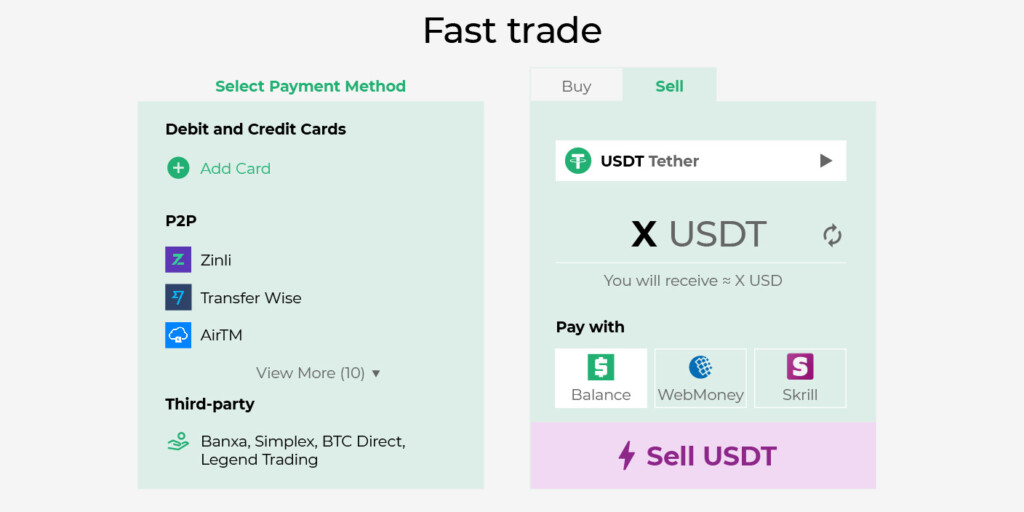

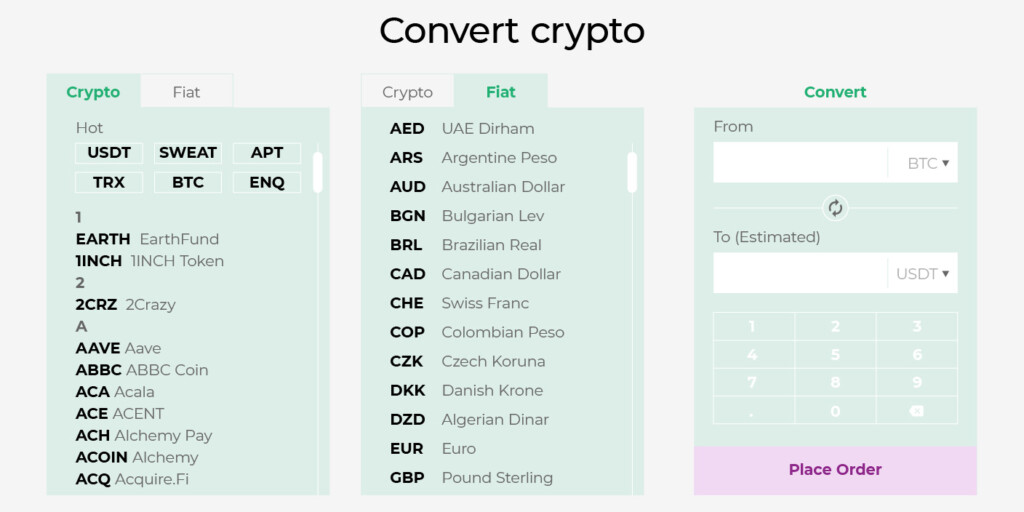

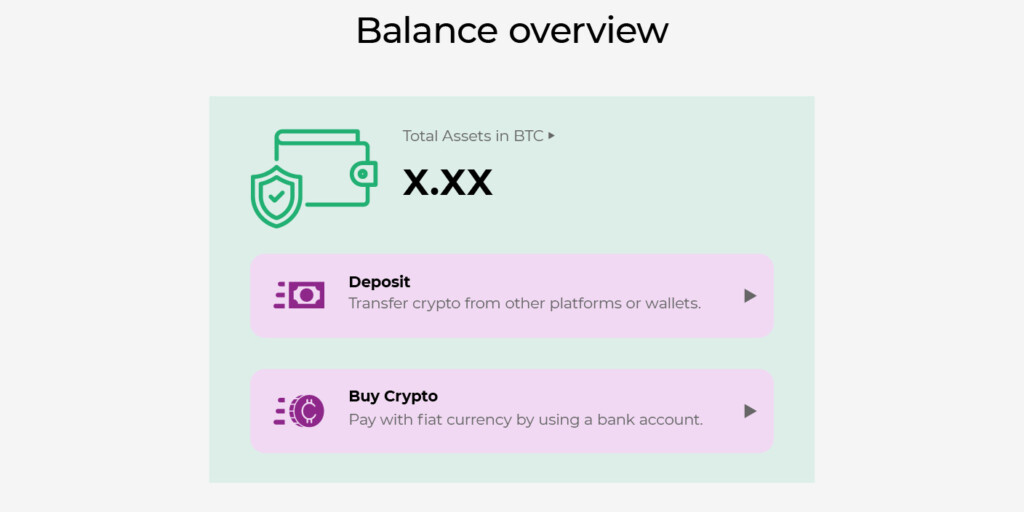

How to convert your fiat for crypto and crypto for fiat and make deposits and withdrawals?

1. Deposit with your fiat (USD, euro, etc.) via a bank card or other payment method and buy cryptocurrency.

2. You can also convert one crypto into another through exchanges.

3. You can check your balance and withdraw your fiat whenever you like.

Note. Via exchanges, you can convert and sell cryptos to get fiat. P2P exchanges allow selling cryptos directly to buyers.

How to pay with cryptocurrency?

With the increasing adoption of cryptocurrencies like Bitcoin, Ethereum, and others, many companies across various industries have started accepting cryptocurrency as a valid form of payment. If you’re interested in paying with cryptocurrency, here’s a step-by-step guide on how to do it.

- Choose a cryptocurrency wallet: To pay with cryptocurrency, you’ll need a digital wallet supporting the cryptocurrency you want. Various types of wallets are available, such as hardware wallets, software wallets, and online wallets. Popular cryptocurrency wallets include Coinbase, Ledger, and Mycelium.

- Check for merchants that accept cryptocurrency: Many well-known companies now accept cryptocurrency as payment. For example, Microsoft allows customers to use Bitcoin to purchase apps, games, and movies on its online store. Overstock, an online retailer, accepts Bitcoin, Ethereum, Litecoin, and other cryptocurrencies for furniture purchases, home decor, and more. Expedia, a prominent travel company, also accepts Bitcoin for hotel bookings.

- Place your order: Once you’ve chosen a merchant that accepts cryptocurrency, simply add the items you want to purchase to your cart or make a reservation as you would with any other online purchase. Select the cryptocurrency payment option at checkout and follow the prompts to complete the transaction.

- Complete the transaction: To pay with cryptocurrency, you’ll need to transfer the appropriate amount of cryptocurrency from your wallet to the merchant’s wallet. This usually involves scanning a QR code or copying and pasting a wallet address provided by the merchant. Double-check the wallet address to ensure accuracy and avoid sending cryptocurrency to the wrong recipient.

- Confirm the transaction: The transaction will be processed on the blockchain network after sending the cryptocurrency. Depending on the cryptocurrency you’re using and the network congestion, the transaction may take some time to be confirmed. Once confirmed, you’ll typically receive a confirmation email or notification from the merchant indicating that your payment has been received.

It’s important to note that paying with cryptocurrency may vary slightly depending on the merchant and your specific cryptocurrency.

Additionally, for those interested in learning how to become a cryptocurrency broker, it’s vital to understand that cryptocurrency transactions are irreversible. This means that once a transaction is made, it cannot be undone, underscoring the importance of ensuring that you send the correct amount to the correct wallet address to avoid any irreversible mistakes.

***

Ready to learn more about how to use cryptocurrencies around the world and get profit? Read on!

You can also check your knowledge of cryptocurrency by passing our new test with a special bonus inside!