There are many Forex trading strategies, which isn’t surprising. After all, Forex is the largest market, which comprises 170+ different currencies. This market provides numerous trading opportunities. Therefore, traders develop new strategies, one of which is arbitrage.

Arbitrage is believed to be a risk-free trading approach. However, it has challenges traders must consider to use it successfully. Read on to discover how to implement arbitrage on Forex.

Basics of the arbitrage strategy

The arbitrage strategy is based on the idea of price inefficiency. A trader buys a currency on one market and sells it through a related pair on another market. The amount of currency is the same, and potential profit arises from the price difference.

Usually, arbitrage is done on a single trading platform. However, there is an option to look for price differences on platforms of different brokers and open simultaneous trades on them. This approach is inefficient because it requires more time, which is vital in arbitrage trading. You risk losing funds because of time lags and technical issues. Moreover, it’s hard to find price divergence on different platforms.

Some traders doubt arbitrage’s legality. However, this approach is legal, as price differences are a part of any market and are caused by market conditions, not by traders’ illegal actions. The most common reasons for price inefficiency are increased volatility and lack of liquidity.

The arbitrage idea is clear once you consider an example.

Types of arbitrage strategy

There are several types of arbitrage strategies you can choose from.

Multi-pair arbitrage

It’s the most common and simplest trading approach. This method relies on price inefficiency between several pairs.

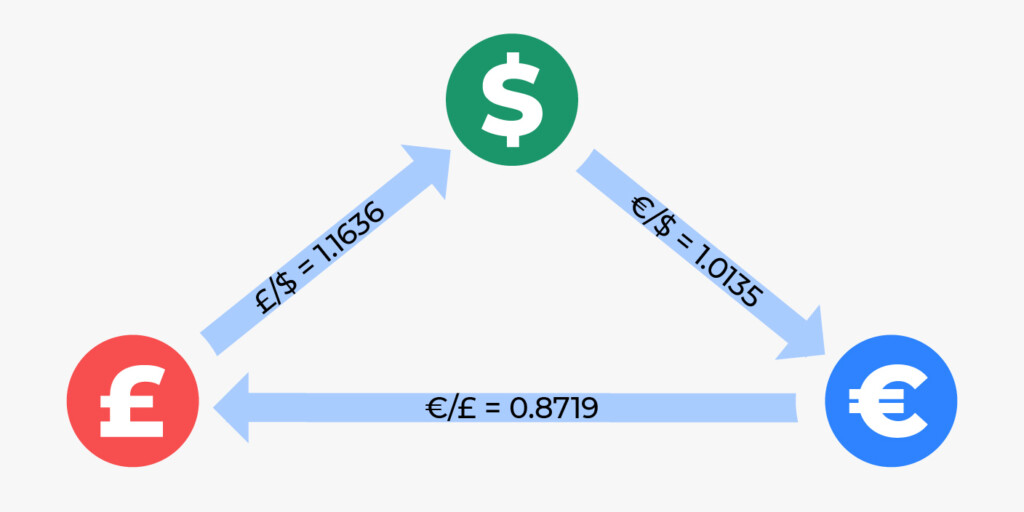

You should choose three interconnected pairs — for instance, EUR/USD, GBP/USD, and EUR/GBP. Imagine, their current rates are 1.0135, 1.1636, and 0.8719, respectively.

To understand whether there is an arbitrage opportunity, you could divide the value of the EUR/USD pair by the value of the GBP/USD pair. 1.0135/1.1636 = 0,8710. This value is lower than the current EUR/GBP rate of 0.8719. This means that there is an arbitrage opportunity.

You decide to buy a mini lot that equals 10,000 units of the EUR/USD pair. In a mini-lot, one pip of this pair will equal $1.00. As a result, you spend 10,135 USD to buy 10,000 Euros. After, you sell 10,000 Euros and get 8,719 British pounds. The final step is to buy USD for 8,719 GBP. In the end, you have $10,145. The profit is $10.

You may ask what the point is of doing so many actions to get only $10. However, if you used a standard lot of 100,000 units, you would get $100.

Undervalued and overvalued assets

The concept of over- and undervalued assets is used in various trading and investing strategies. It is also used in arbitrage trading, but it partially relates to it.

This approach doesn’t involve calculations and is based on fundamental analysis; however, it may include technical indicators. A trader’s task is to find under- and overvalued assets and trade with a belief they will reach their fair prices soon.

For example, using analyst reviews and news, you find that the Euro is overvalued against the US dollar. In this case, you sell euros and buy dollars.

A reminder: when you open a trade on Forex, you automatically buy one currency in the pair and sell another.

This strategy can also be implemented for a basket of assets. You buy several undervalued currencies and sell several overvalued currencies.

Arbitrage pitfalls

Arbitrage isn’t as simple as it seems. There are some challenges you may face.

Costs

The examples above reflect ideal conditions when you don’t bear any costs. However, every position you open will include additional expenses.

Too quick

Arbitrage is a short-term strategy requiring traders to be quick in their decisions and actions. Retail traders compete with institutional investors who use bots to catch opportunities. That’s why such an opportunity lasts less than a second. Therefore, many traders use bots. Bots can find arbitrage opportunities and alert about them through notifications or open trades with no trader involvement.

Takeaway

The arbitrage trading strategy can be highly effective if you use bots. As market quotes change in less than a second, looking for Forex arbitrage manually won’t allow you to open successful trades. Moreover, arbitrage requires counting the expenses you will bear from opening several trades.